Year after year, countless people across India aim for roles in banks. These positions promise steady progress, solid work conditions, time-tested reliability. While finance shifts through tech advances, new rules, tighter races between firms, employment at banks holds strong as a dependable path – especially for those finishing studies or already building careers. What pulls them isn’t just landing such a role, but seeing how advancement stretches out, step by slow step, over many years.

This piece lays out what climbing the ladder looks like in Indian banking – no sugarcoating, no guesswork. How do you move up? That part breaks down step by step. Shifts between branches or cities pop up for reasons some overlook – it shows when those occur. Stability past 2026 gets weighed without leaning on old myths. People starting out, hunting jobs, guiding kids, or already working find it useful simply because confusion fades here.

Why banking work still holds weight in India

Still seen as steady, bank work in India carries weight with families. Rules guide how things run, making daily tasks clear from the start. Where other businesses shift fast when profits dip, these roles tend to hold ground. Respect follows those who manage money for others, quietly. Stability matters most when change feels constant elsewhere.

Beyond just a job, banking offers paths that unfold step by step, not left to chance. Some people find comfort in knowing what lies ahead, blending daily work with life goals without constant guesswork.

Starting out in a banking career

Starting out in banking usually means getting hired after a tough test. Roles like clerk, trainee officer, or expert hire open the door. Learning how banks run things comes first – helping customers, following rules, using software tools. Those beginning years shape what you know. Getting familiar with daily bank life matters most.

Starting out might take effort, yet that stretch builds readiness for tougher roles ahead. Moving up in banking isn’t about hopping jobs – it ties back to steady work and how you do on inside reviews.

How promotions work in Indian banking

Every step up in India’s banking jobs sticks to clear rules. After spending enough time in one role, workers can move forward. Moving ahead often means passing tests run by the bank itself. Talking with senior staff also plays a part. How well someone does at work weighs heavily too.

Fairness shows up most when steady effort counts more than quick wins. Those who study hard for company tests move ahead by sticking with it. Good behavior on the job opens doors slowly but surely. Step by step, preparation pays off across years, not weeks.

Promotion pace and long-term growth

Starting out, movement up the ladder tends to happen after several years of steady work. Reaching top roles takes more time, often tied to how much hands-on know-how someone has built. Step by step, people learn what it takes to lead teams effectively. Growth here is slow on purpose – giving room to handle tougher tasks with confidence later.

Pacing up the ladder might feel sluggish when set beside some fast-moving corporate jobs. Still, here you get a clear picture of what each next step demands. That clarity makes it easier to map out where you’re headed. People can line up their goals because the path forward stays steady.

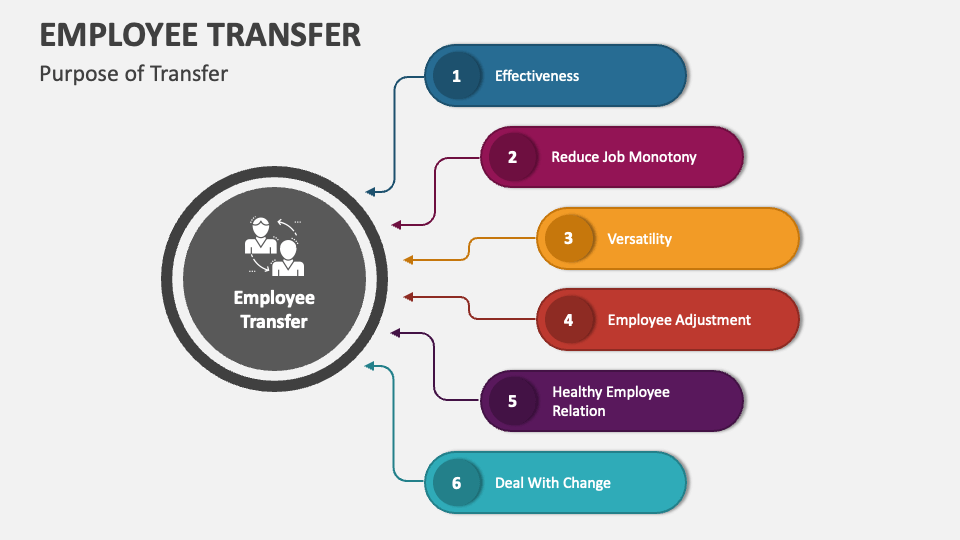

Transfers in banking jobs explained

Nowhere is job movement more routine than in banking, where shifts between branches happen regularly. These moves aim to keep workloads steady, refresh team energy, avoid long-term ruts, plus spread seasoned workers evenly. Rules usually guide them, based on set time limits at one post before moving on. Change like this isn’t random – it follows structure others have followed before.

Starting out, workers often find themselves assigned to villages or small towns. Such roles open doors to different kinds of customers and real-world bank problems. With time and growth in rank, new opportunities arise – locations become easier, schedules settle down.

Do transfers slow career progress?

Could moving posts actually hold someone back? Not always. Working across areas builds flexibility on the job, opens doors for advancement. When reviewing move applications, banks look at individual situations – family commitments or health matters matter more as roles grow in responsibility.

Fewer moves tend to happen later on, since longer tenure often means staying put more easily as years go by.

Work-life rhythm in banking roles

Starting a career in banking often means handling steep learning curves early on. Moving up, leadership duties bring weightier choices to manage daily. Some days stretch long, depending on where you are stationed. Still, set schedules show up regularly across most departments. Time off follows clear guidelines written into policy. Public holidays usually mean no work at all. Higher ranks trade some flexibility for greater accountability.

Beyond typical office jobs, a career in banking often brings more predictable scheduling over time – this fits well when someone wants steady progress without sacrificing personal rhythm. Still, the path isn’t rushed; it unfolds at a pace that balances ambition with consistency.

Long-term stability in Indian banking careers

Stability sticks around longer in bank roles, a big draw for those picking this path. When times get tough economically, positions at state-backed banks usually hold firm – rarely shaken loose overnight. Because of that steady ground, workers map out budgets, life plans, even years past work, without constant worry. Knowing what comes next matters more than most admit.

Fueled by shifts in tech, bank operations evolve – yet demand for capable staff holds steady.

Skill growth and changing roles

Today’s bank jobs go beyond serving customers at desks. Moving up might mean working with loans, spotting financial risks, following regulations, building online tools, teaching staff, or handling office tasks. Shifting paths inside the sector keeps work fresh when markets shift. Careers stay alive without leaving familiar ground behind.

Staying sharp in banking means growing skills that last. A career moves forward when learning never stops. What keeps you valuable? Building abilities that stick around. Future-proofing isn’t magic – it’s practice over time. Growth doesn’t shout; it shows up quietly in daily effort.

Government banks and private banks compared

A steady climb matters most inside government-run banks, where roles open up by design over time. Moving fast happens more behind private desks – yet nerves stay tested under constant targets. What fits one person might weigh heavy on another’s shoulders. Some chase calm routines; others lean into sharp turns without clear maps ahead.

When steady choices matter, many still lean on government banks for lasting safety. Not chasing trends, these institutions offer a calm path through uncertain times. Their strength lies in reliability, standing apart from fast-moving financial shifts. Through changes elsewhere, they hold firm with quiet confidence.

Final thoughts on banking careers in India

A path in Indian banking still brings clear advancement, hands-on experience, steady footing. Moving up happens through open processes, relocations depend on set rules, protection in work holds firm well into 2026. Those looking for a future that unfolds without surprises often find trust and honor here.

Frequently Asked Questions (FAQ)

How does career growth work in banking jobs in India?

Faster progress comes from passing tests on schedule. Staying long helps open higher roles. Reviews decide if a worker fits the next level. Moving up means shifting into clearer job steps. Interviews check readiness when chances appear.

Banking jobs see raises at different times. Some workers move up every few years. Others wait longer. Timing depends on the bank. Performance plays a role too. People sometimes shift roles instead of rising straight ahead. Each case varies widely.

How fast someone moves up often depends on the bank they work at, also what job they’re in. Some get ahead fairly soon – just a couple of years in. Higher positions? Those tend to take more time. Staying sharp and delivering matters most there.

Are transfers compulsory in banking jobs?

Transfers happen often in bank jobs. These moves follow set rules, typically kicking in after someone has stayed in one place long enough. Stability tends to grow with years on the job, slowly shaping where people land.

What about time off when working at a bank? Does it leave room for personal life?

Banking jobs often let people leave on time, thanks to set schedules that make planning easier. Time off follows clear rules, so taking breaks feels less uncertain. Holidays come at expected times, which helps life outside work stay steady. Compared to other corporate positions, this setup usually means fewer late nights.

What about lasting security in Indian bank careers now?

True enough. Public bank roles still bring reliable paychecks, lasting work options, among them a firm hold on future plans.

Future looking at bank work – could it fit your path?

Beyond chance and habit, some choose banking in India for its clear paths forward. Not just pay, but standing tall among peers matters here. Stability stretches ahead, drawn by routine and reach. Careers anchor deep where trust flows steady.